Découvrez Folk, le CRM pour les entreprises axées sur les ressources humaines

Mergers and acquisitions are high-stakes, fast-moving, and filled with complexity. For teams of 20-50 professionals, tracking multiple stakeholders, managing due diligence, and ensuring seamless communication can feel overwhelming—especially when millions (or even billions) are on the line.

This is where the best CRM for mergers and acquisitions becomes your competitive edge. The right CRM doesn't just store contacts; it streamlines deal flow, automates follow-ups, centralizes key documents, and provides real-time visibility into your pipeline—so nothing falls through the cracks.

In this guide, we'll break down the top CRM solutions built for M&A teams of 20-50 people, helping you close deals faster, collaborate efficiently, and maximize value at every stage of the transaction.

The 5 best CRMs for mergers and acquisitions

👉🏼 Try folk now to centralize your M&A deal pipeline and never miss a follow-up

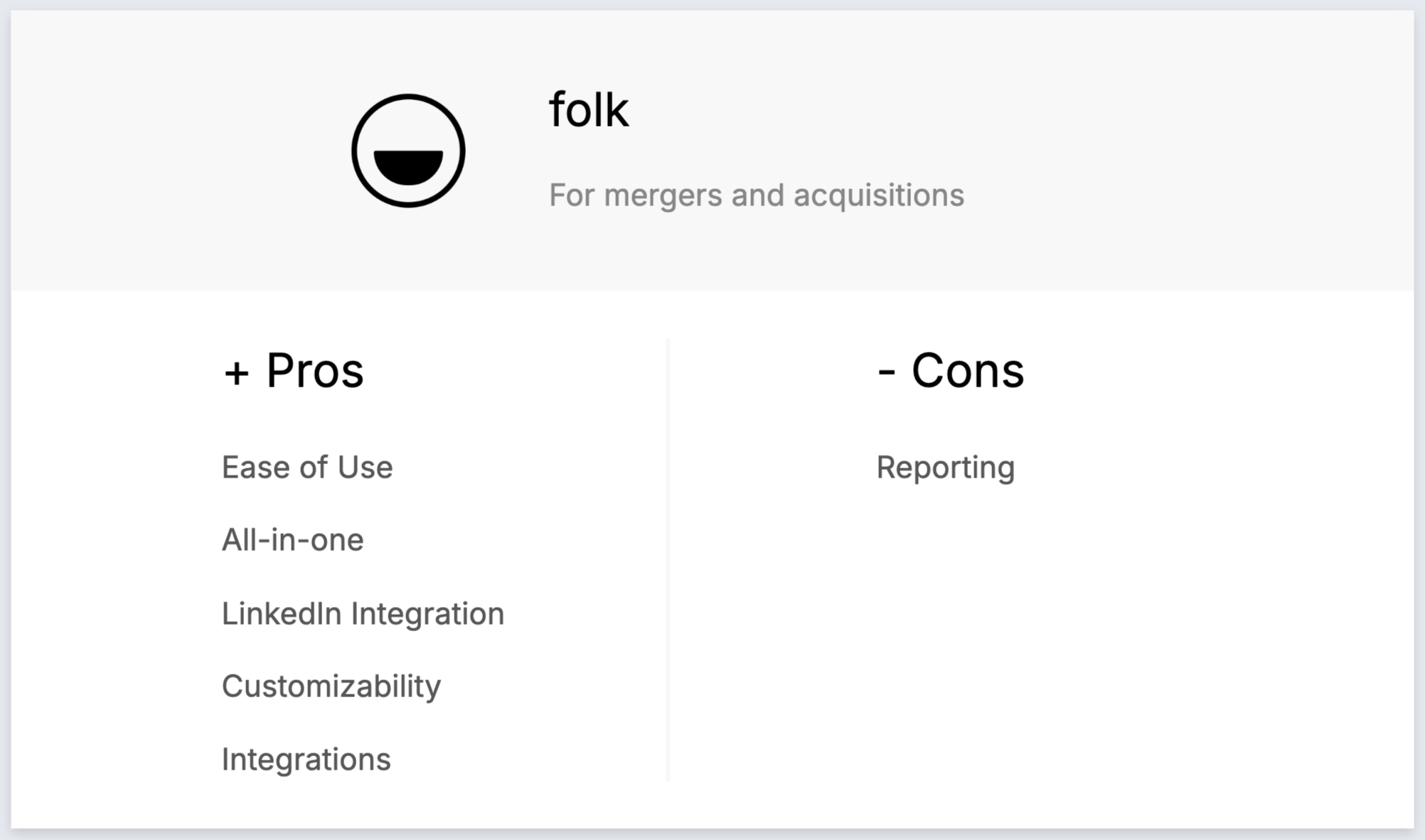

1. folklore

folk is the ideal CRM platform for M&A teams of 20-50 people, offering customizable pipelines, AI-driven tools, and seamless integrations that transform how mid-sized teams manage complex deal workflows, investor relationships, and acquisition targets.

Caractéristiques principales

- Contact enrichment: Automatically enriches contact details for key executives, board members, and decision-makers in target companies, finding verified emails and LinkedIn profiles to accelerate your M&A outreach without manual research.

- Social media integration: Seamlessly import contacts from LinkedIn, Instagram, Twitter and more to centralize all stakeholder information, from investment bankers to company executives, using templates for consistent professional communication across deals.

- Mail merge and email sequences: Full email sync with sophisticated templates and tracking features, enabling M&A teams to manage confidential communications, LOI distributions, and investor updates directly from the CRM.

- AI-powered features: AI tools specifically designed for relationship management assist in prioritizing acquisition targets, automating follow-up sequences, and suggesting next actions to optimize deal velocity for busy M&A professionals.

- Integrations: folk integrates seamlessly with over 6,000 apps, including Gmail, Zapier, DocuSign, and virtual data rooms, allowing M&A teams to centralize their tech stack and eliminate the manual data entry that slows down time-sensitive deals.

Avantages

- Perfect for mid-sized M&A teams: folk's intuitive interface allows teams of 20-50 people to onboard quickly without extensive training, crucial when deal timelines don't allow for lengthy CRM implementations.

- All-in-one M&A workflow: folk eliminates the need for multiple tools by allowing teams to import target company contacts from LinkedIn, automatically find executive emails, execute confidential outreach campaigns, and track deal progress in customizable pipelines—saving both time and budget.

- Rapid customization: Custom fields, deal stages, and workflows can be configured quickly to match your M&A process, whether you're tracking buy-side targets, sell-side mandates, or investor relations.

- Enterprise-grade integrations: With 6,000+ integrations including DocuSign, Slack, and major data room providers, folk scales with your M&A tech stack without requiring dedicated IT resources.

Inconvénients

- Advanced reporting and analytics: Includes pipeline and deal-stage analytics, revenue forecasting with weighted probabilities, and performance breakdowns by owner, channel, industry, region, or any custom field.

Prix et forfaits

folk offers transparent pricing perfect for M&A teams of 20-50 people, with a 14-day free trial to test all features on live deals.

- Standard: $20 per user, per month—ideal for smaller M&A boutiques.

- Premium: $40 per user, per month—perfect for mid-market M&A teams needing advanced automation.

- Custom: Starts from $60 per user, per month—designed for specialized M&A workflows and enterprise integrations.

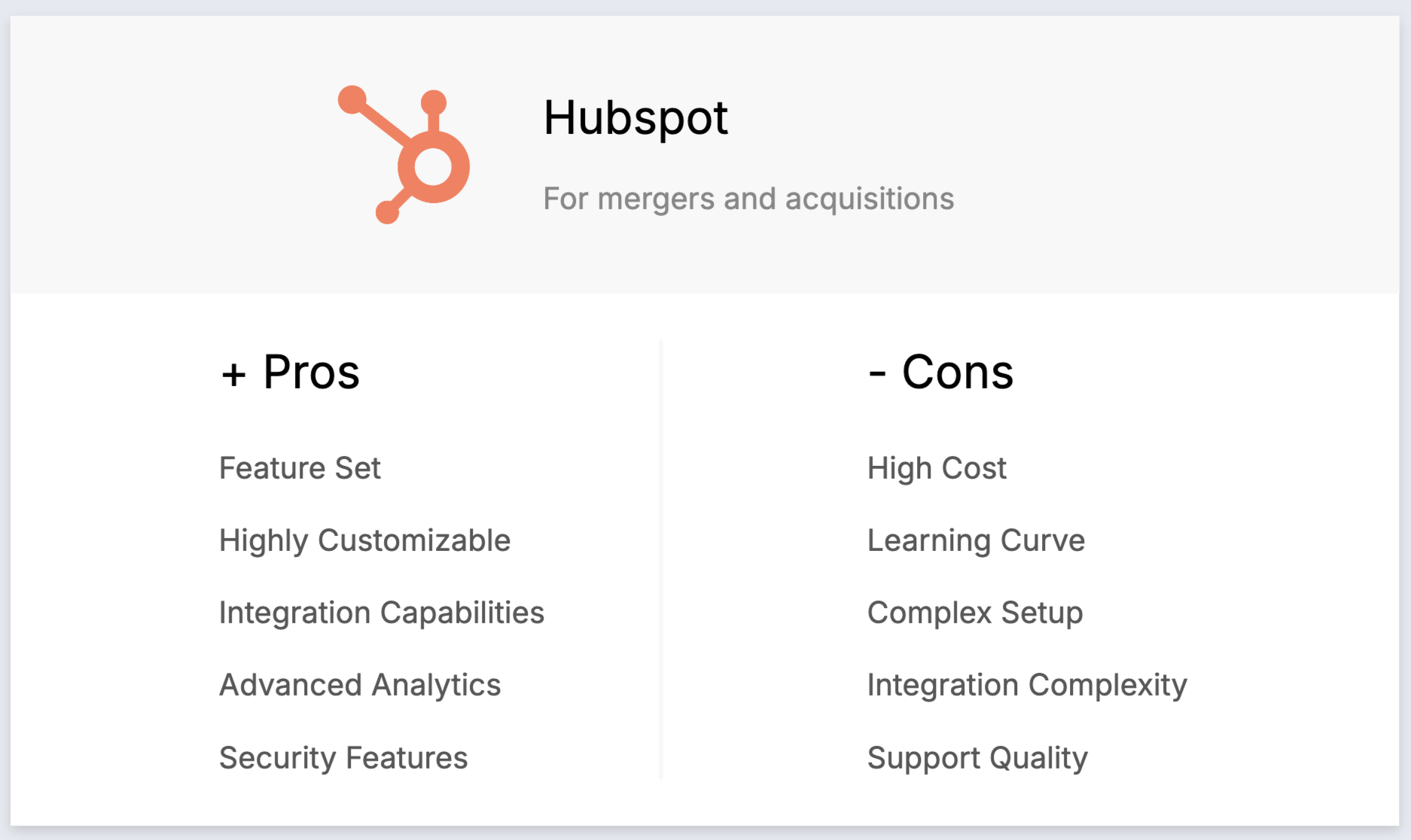

2. HubSpot

HubSpot CRM is a user-friendly, scalable platform offering integrated tools for managing sales, marketing, customer service, and operations, though it can become costly for M&A teams as they scale beyond basic features.

Caractéristiques principales

- Marketing Hub: Includes email marketing, ad tracking, landing pages, and lead generation tools. Useful for generating leads and nurturing potential investors, though less specialized for M&A confidential processes.

- Sales Hub: Provides deal tracking, pipeline management, sales automation, and reporting. Covers basic M&A deal management but lacks industry-specific customization for complex transactions.

- Operations Hub: Syncs and automates business processes across different systems, helping with basic integration needs during mergers.

- Lead scoring: Prioritize leads with predictive scoring to improve sales efficiency, though M&A deals require more nuanced qualification criteria than standard lead scoring provides.

- Customizable dashboard and reports: Allows users to create customized dashboards and reports to track metrics, though advanced M&A analytics may require expensive add-ons.

Avantages

- User-friendly interface: HubSpot is known for its intuitive interface, making it accessible for M&A teams, though it requires more setup than folk for specialized M&A workflows.

- Integrated marketing tools: HubSpot integrates smoothly with its marketing, sales, and service hubs, useful for M&A teams needing basic marketing capabilities alongside deal management.

- Automation capabilities: Provides automation tools for email marketing, lead nurturing, and sales workflows, helping M&A teams save time on routine communications.

- Scalability: The platform offers different tiers that cater to growing businesses, from small boutiques to larger M&A practices.

- Customer support: HubSpot provides solid customer support, including live chat, phone support, and knowledge base resources.

Inconvénients

- Expensive for M&A teams: HubSpot's pricing escalates quickly for teams of 20-50 people needing advanced features, often reaching $22,500-$75,000 annually compared to folk's $4,800-$36,000 range.

- Limited customization in lower tiers: The free and starter plans have restrictive customization options, insufficient for complex M&A deal tracking and stakeholder management.

- Complexity in advanced features: M&A-specific workflows like confidential deal rooms, investor communications, and regulatory compliance tracking require extensive customization and training.

- Additional costs for essential M&A features: Advanced CRM capabilities, specialized integrations, and workflow automation come as expensive add-ons, increasing total cost of ownership.

- Over-engineered for M&A needs: HubSpot's marketing-heavy approach includes many features irrelevant to M&A teams, creating unnecessary complexity compared to folk's focused M&A workflow design.

Prix et forfaits

HubSpot's pricing becomes expensive quickly for M&A teams of 20-50 people, with annual subscription costs as follows.

- Starter: $15 per user, per month (limited M&A functionality).

- Professional: $450 per user, per month ($270,000 annually for 50 users).

- Enterprise: $1,500 per user, per month ($900,000 annually for 50 users).

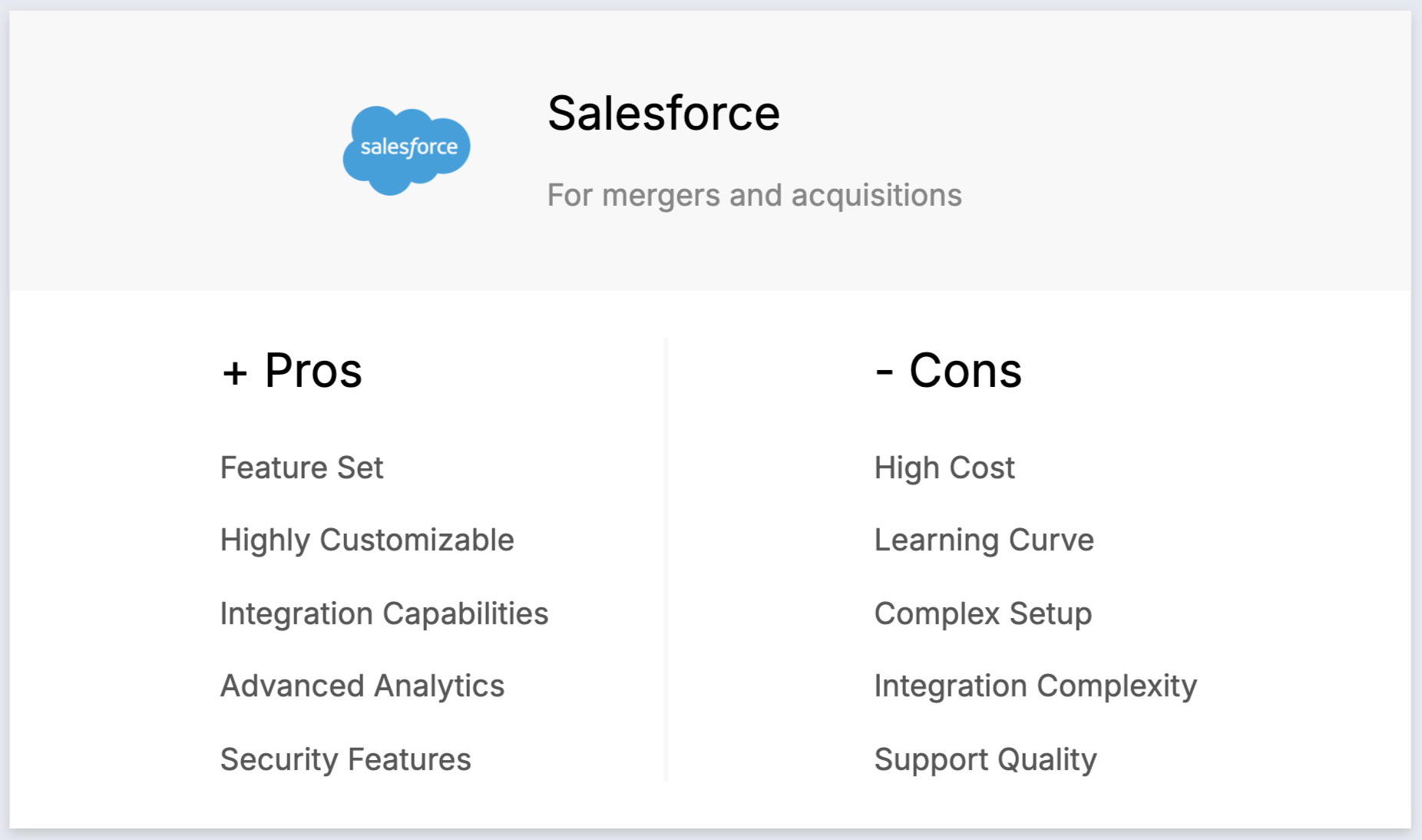

3. Salesforce

Salesforce is a robust CRM platform designed for large enterprises, offering extensive tools for sales, marketing, service, and analytics, but often overwhelming and costly for mid-sized M&A teams of 20-50 people.

Caractéristiques principales

- Comprehensive ecosystem: A unified platform offering CRM, marketing automation, customer service, and custom app development, though this breadth often creates complexity for focused M&A workflows.

- Enterprise customization: Salesforce is highly customizable and scalable, but requires dedicated IT resources and extensive setup time that many mid-sized M&A firms lack.

- Einstein AI integration: Salesforce Einstein offers AI-driven analytics and automation, though it requires significant configuration to be relevant for M&A-specific processes.

- Extensive integration capabilities: With Salesforce's AppExchange, M&A firms can theoretically integrate with many third-party applications, but implementations are complex and often require consultants.

- Enterprise security: Salesforce provides robust security measures and compliance features, suitable for handling sensitive M&A data, though this comes at premium pricing.

Avantages

- Comprehensive functionality: Salesforce offers extensive features covering sales, service, and marketing, providing everything needed for large-scale M&A operations, though most mid-sized teams don't need this complexity.

- Enterprise-grade customization: Highly customizable platform allows M&A firms to tailor workflows extensively, but requires significant technical expertise and time investment.

- Advanced analytics: Powerful analytics and reporting tools provide deep insights, though they require extensive configuration and training to be useful for M&A metrics.

- Third-party integrations: Vast integration ecosystem through AppExchange, though implementations often require expensive consultants and lengthy setup periods.

- Enterprise security: Robust security measures including data encryption and compliance features, essential for sensitive M&A data but reflecting in premium pricing.

Inconvénients

- Prohibitive cost for mid-sized teams: Salesforce can cost $99,000-$990,000 annually for a 50-person M&A team, compared to folk's $24,000-$36,000, making it financially impractical for most mid-market firms.

- Overwhelming complexity: The extensive feature set creates a steep learning curve that can take months for M&A teams to master, slowing deal execution when speed is critical.

- Complex setup requirements: Initial setup and customization often require certified consultants costing $150-$300/hour, adding tens of thousands in implementation costs.

- Over-engineered for M&A needs: Most features are irrelevant to M&A workflows, creating unnecessary complexity compared to folk's focused approach designed specifically for deal management and relationship tracking.

- Integration complexity: While extensive, integrations require technical expertise and ongoing maintenance that mid-sized M&A teams typically lack internally.

Prix et forfaits

- Starter Suite: $25/user/month provides basic CRM features insufficient for M&A complexity.

- Pro Suite: $100/user/month ($60,000 annually for 50 users) includes advanced tools still requiring extensive customization.

- Enterprise Plan: $165/user/month ($99,000 annually) offers customization suitable for M&A but at premium cost.

- Unlimited Plan: $330/user/month ($198,000 annually) provides comprehensive features for large enterprises.

- Einstein 1 Sales: $500/user/month ($300,000 annually) offers AI-driven insights at enterprise pricing levels.

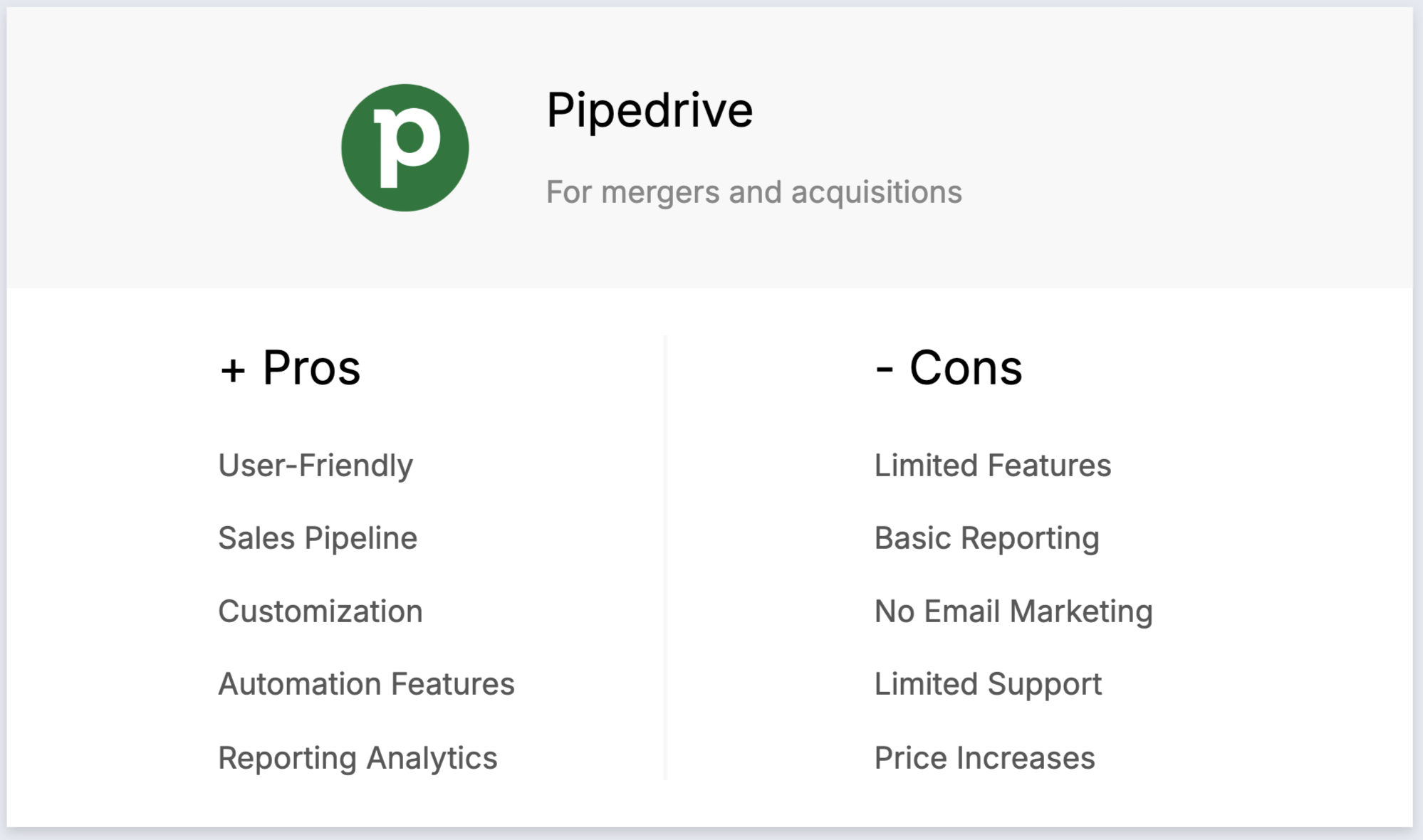

4 Pipedrive

Pipedrive is a sales-focused CRM designed for small businesses, offering lead management, automation, and customizable pipelines, but lacking the sophisticated features needed for complex M&A transactions and stakeholder management.

Caractéristiques principales

- Basic lead management: Centralized tools to manage leads and opportunities, though lacking the sophistication needed for complex M&A stakeholder relationships and confidential deal tracking.

- Simple sales automation: Basic workflow automation for routine tasks, but insufficient for the complex, multi-stage processes typical in mergers and acquisitions.

- Email integration: Standard email sync and templates, though lacking the advanced communication features needed for sensitive M&A correspondence and investor relations.

- Basic reporting: Simple analytics and reporting tools that provide limited insights compared to the comprehensive M&A metrics and forecasting capabilities teams need.

- Standard customization: Basic pipeline and field customization options, though not flexible enough for the complex deal structures and regulatory requirements in M&A transactions.

Avantages

- Simple interface: Easy-to-navigate interface suitable for basic sales processes, though M&A teams quickly outgrow its limited functionality.

- Visual pipeline: Clean pipeline visualization that works for simple deal tracking, but lacks the complexity needed for multi-party M&A transactions.

- Basic customization: Some customization options for fields and workflows, though insufficient for the specialized needs of M&A deal management.

- Standard automation: Basic automation features for routine tasks, but not sophisticated enough for complex M&A communication sequences and stakeholder management.

- Simple reporting: Basic reporting tools that provide standard metrics, though lacking the advanced analytics M&A teams need for deal evaluation and forecasting.

Inconvénients

- Insufficient for M&A complexity: Pipedrive lacks the advanced features M&A teams need, including sophisticated stakeholder management, confidential deal rooms, and complex workflow automation.

- Limited reporting capabilities: Basic reporting features are inadequate for the detailed analytics, deal forecasting, and performance metrics essential in M&A operations.

- No advanced communication tools: Lacks the sophisticated email sequences, document management, and confidential communication features required for sensitive M&A processes.

- Missing M&A-specific features: No built-in support for due diligence tracking, regulatory compliance, or the complex approval workflows typical in mergers and acquisitions.

- Limited scalability: Designed for simple sales processes, Pipedrive cannot scale effectively with the growing complexity and sophistication of M&A operations.

Prix et forfaits

While initially affordable, Pipedrive's limited functionality requires additional tools for M&A teams, increasing total cost.

- Essential plan: $24 per user, per month (basic features insufficient for M&A).

- Advanced plan: $44 per user, per month (still lacking M&A-specific capabilities).

- Power plan: $79 per user, per month (some advanced features but incomplete for M&A needs).

- Enterprise plan: $129 per user, per month (approaching folk's pricing without M&A specialization).

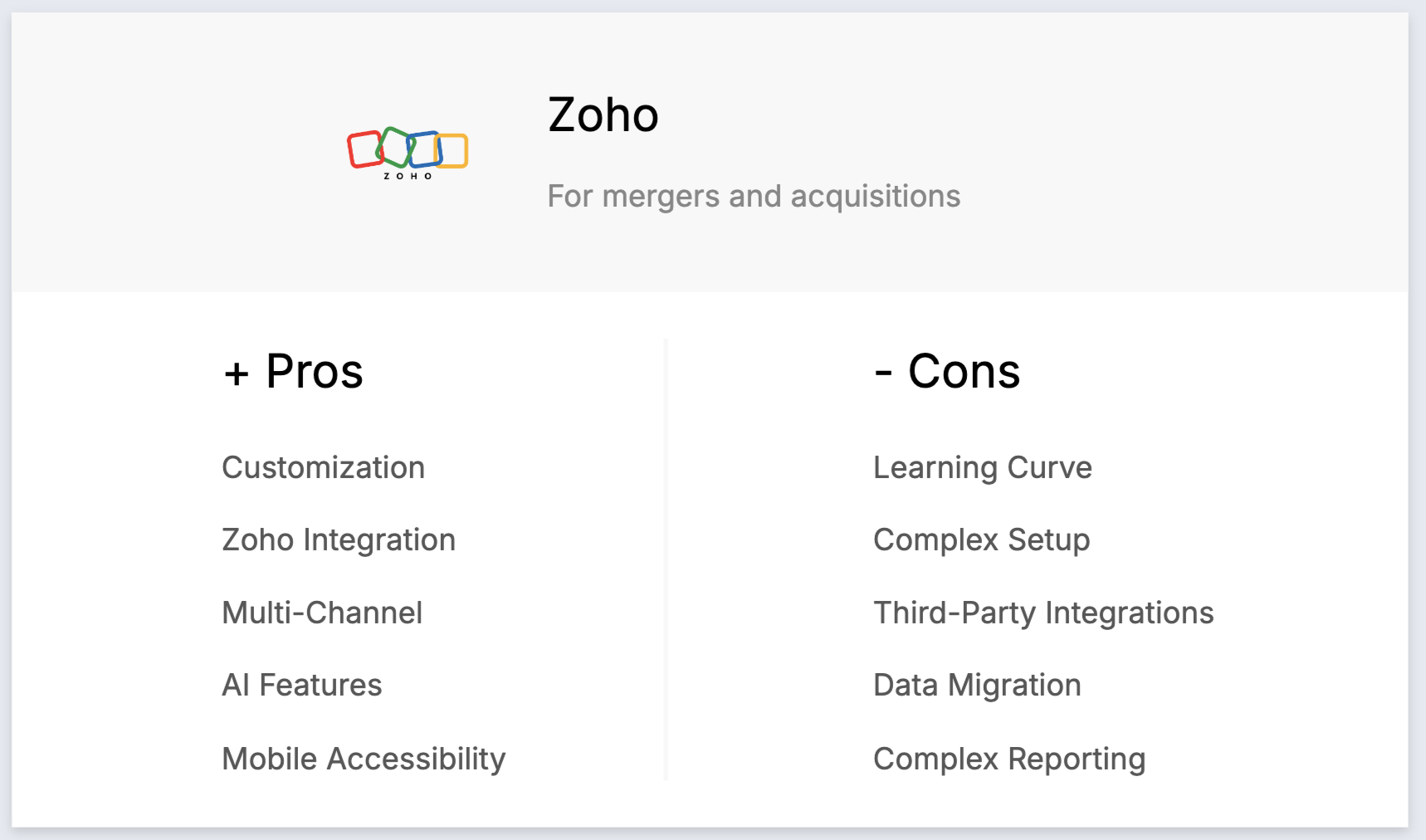

5. Zoho

Zoho is a budget-friendly CRM system with sales automation, workflow management, and marketing tools, though it requires complex setup and lacks the intuitive design that M&A teams of 20-50 people need for efficient deal management.

Caractéristiques principales

- Contact management: Basic investor and stakeholder information management with contact segmentation, though lacking the sophisticated relationship mapping needed for complex M&A transactions.

- Customizable dashboards: Users can create custom dashboards and reports, though the setup process is complex and time-consuming for busy M&A teams.

- Pipeline management: Visual deal pipeline with drag-and-drop functionality, suitable for basic M&A tracking but lacking advanced deal structuring and approval workflow features.

- Multi-channel communication: Integrates email, phone, social media, and live chat, though without the specialized communication templates and confidentiality features M&A teams require.

- Basic workflow automation: Automates routine tasks and processes, but requires extensive configuration and lacks the sophisticated automation M&A teams need for complex deal sequences.

Avantages

- Budget-friendly pricing: Lower cost compared to enterprise alternatives, making it attractive for cost-conscious M&A teams, though the savings come at the cost of ease-of-use and M&A-specific functionality.

- Zoho ecosystem integration: Works well with other Zoho products, creating a unified suite, though most M&A teams prefer best-in-class integrations with specialized tools rather than being locked into one vendor.

- Extensive customization: Highly customizable fields, modules, and workflows, but this flexibility comes with complexity that requires dedicated technical resources to manage.

- AI-powered insights: Zia AI assistant provides some automation and analytics, though it requires significant configuration to be useful for M&A-specific processes.

- Mobile accessibility: Robust mobile app with offline capabilities, useful for M&A teams traveling between meetings and due diligence sessions.

Inconvénients

- Complex setup and learning curve: Extensive customization options overwhelm M&A teams who need to focus on deals, not CRM configuration, requiring weeks of setup time compared to folk's immediate usability.

- Time-intensive implementation: Complex setup and configuration process demands significant technical expertise that most mid-sized M&A firms lack internally.

- Limited third-party integrations: While Zoho integrates well within its ecosystem, connections with specialized M&A tools, data rooms, and financial platforms are limited or require custom development.

- Data migration challenges: Moving existing M&A data from other systems is difficult and often requires manual adjustments, creating risk of data loss during critical deals.

- Counterintuitive interface: Unlike folk's intuitive design, Zoho's interface is clunky and requires extensive training for M&A teams to use effectively, slowing adoption and productivity.

Prix et forfaits

While Zoho appears cost-effective, implementation complexity and limited M&A functionality often require additional tools and consulting.

- Standard: $20 per user, per month (basic features, complex setup required).

- Professional: $35 per user, per month (more features but still requires extensive configuration).

- Enterprise: $50 per user, per month (advanced features with significant setup complexity).

Pourquoi vous avez besoin d'un CRM

For M&A teams of 20-50 people managing complex transactions, investor relationships, and acquisition targets, a specialized CRM like folk transforms chaotic deal management into streamlined operations that maximize opportunities and close deals faster.

Les défis sans CRM

M&A teams of 20-50 people face unique challenges without a proper CRM system in place:

- Deal information scattered: Managing multiple simultaneous acquisitions leads to critical deal details, stakeholder contacts, and due diligence documents spread across email, spreadsheets, and individual team members' files.

- Missed investor opportunities: Without centralized tracking, potential investors, strategic buyers, and acquisition targets fall through the cracks, costing millions in lost deal value.

- Inefficient deal processes: Manual data entry, duplicate contact management, and fragmented communication tools slow down time-sensitive M&A transactions where speed determines success.

- Limited deal insights: Inadequate data analysis prevents teams from identifying deal patterns, investor preferences, and market trends essential for strategic M&A decision-making.

- Communication breakdowns: Inconsistent stakeholder communication during sensitive M&A negotiations can derail multi-million dollar transactions and damage critical business relationships.

Avantages d'un CRM

A specialized CRM like folk delivers transformative benefits for M&A teams of 20-50 people:

- Centralized deal management: All acquisition targets, investor information, and transaction details stored in one secure location, ensuring your entire M&A team has access to current deal status and stakeholder information.

- Accelerated deal velocity: Automated workflows, contact enrichment, and email sequences eliminate manual tasks, allowing M&A professionals to focus on high-value activities like negotiation and relationship building.

- Enhanced stakeholder relationships: Systematic tracking of all interactions with investors, executives, and advisors ensures personalized communication and timely follow-ups that strengthen critical M&A relationships.

- Data-driven M&A decisions: Real-time pipeline analytics, deal forecasting, and performance metrics provide insights that help M&A teams prioritize opportunities and allocate resources effectively.

- Increased transaction success: Efficient lead management, systematic relationship tracking, and automated communication sequences boost deal completion rates and maximize transaction value.

- Seamless team collaboration: Unified communication channels and shared deal visibility ensure all M&A team members stay aligned on transaction progress and stakeholder requirements.

How to boost your mergers and acquisitions efficiency with a CRM

M&A teams of 20-50 people can dramatically improve their deal efficiency and success rates by implementing these CRM-powered strategies designed specifically for mergers and acquisitions workflows.

1. Cartographiez votre processus

Create a systematic approach to your M&A pipeline by defining clear stages from initial target identification to transaction closing. A sophisticated CRM like folk allows M&A teams to establish custom stages such as "Target Screening," "Management Presentation," "LOI Negotiation," "Due Diligence," and "Integration Planning." You can assign specific tasks to team members at each stage, set automated reminders for critical deadlines, and monitor deal progress in real-time. This systematic approach helps identify bottlenecks in your M&A process and ensures critical M&A milestones and deliverables aren't overlooked during complex transactions.

2. Qualification des prospects

Develop sophisticated criteria for evaluating acquisition targets, strategic investors, and transaction opportunities tailored to your M&A strategy. Use advanced scoring models to rank prospects based on M&A-specific factors like EBITDA multiples, strategic fit, management quality, and regulatory considerations. This allows your team to prioritize high-potential opportunities, allocate due diligence resources efficiently, and focus relationship-building efforts on the most promising deals, ultimately improving transaction success rates.

3. Sensibilisation et suivi

Execute professional, confidential communication campaigns with acquisition targets, investors, and intermediaries. Utilize specialized email templates designed for M&A communications, integrate with LinkedIn to build relationships with key executives, and schedule systematic follow-up sequences that respect the sensitive nature of M&A discussions. Track engagement metrics to identify the most responsive contacts and optimize your outreach timing and messaging for maximum impact.

4. Automate your campaigns

Develop sophisticated nurturing strategies for your M&A pipeline by creating targeted campaigns for different stakeholder groups. Use segmentation to customize communications for sell-side targets, buy-side opportunities, and potential investors. Automated workflows can deliver relevant market updates, transaction case studies, and industry insights that keep your M&A pipeline warm while demonstrating your expertise and maintaining top-of-mind awareness during lengthy M&A cycles.

Comment évaluer et choisir une plateforme CRM

M&A teams of 20-50 people need specialized evaluation criteria to ensure their chosen CRM can handle complex deal management, stakeholder relationships, and confidential transaction processes that define successful mergers and acquisitions.

1. Définissez vos besoins

When selecting the best CRM for mergers and acquisitions, focus on features specifically designed for complex transaction management and stakeholder coordination. M&A teams need sophisticated deal tracking, multi-party communication management, and secure document coordination capabilities that streamline due diligence and integration processes. Additionally, ensure the CRM supports confidential communications, regulatory compliance tracking, and integration with specialized M&A tools like virtual data rooms and financial modeling software.

Key features of a CRM for mergers and acquisitions

- Sophisticated deal automation: Advanced workflow automation designed for complex M&A processes, from initial target identification through due diligence, negotiation, and closing, freeing up valuable time for strategic relationship building and deal execution.

- Executive contact enrichment: Automatically discovers and verifies contact information for C-suite executives, board members, and key decision-makers at target companies, enabling immediate outreach to the right stakeholders without manual research.

- Multi-stage deal pipeline: Customizable pipeline stages specifically designed for M&A transactions, including target screening, management presentations, LOI negotiations, due diligence phases, and integration planning, providing clear visibility into deal progress.

- Confidential communication management: Secure email sequences and templated communications designed for sensitive M&A discussions, ensuring professional, consistent messaging while maintaining confidentiality throughout the transaction process.

- Professional network integration: Seamless LinkedIn integration allows M&A teams to build relationships with target company executives, industry contacts, and potential investors directly from the CRM, expanding deal sourcing capabilities across professional networks.

- M&A analytics and forecasting: Specialized reporting designed for M&A metrics including deal velocity, pipeline value, success rates by industry or deal size, and predictive forecasting to help teams make data-driven decisions about resource allocation and deal prioritization.

2. Considérations budgétaires

For M&A teams of 20-50 people, evaluate CRM costs against the potential value of improved deal efficiency and success rates. folk CRM offers transparent pricing from $20-$60 per user monthly, delivering $24,000-$36,000 annual costs for a 50-person team, compared to $60,000-$300,000+ for enterprise solutions like HubSpot or Salesforce. Consider that a specialized M&A CRM can pay for itself by accelerating just one additional deal per year or improving deal terms through better stakeholder management and process efficiency.

3. Processus de sélection

Choose CRM vendors who understand the unique requirements of M&A transactions and relationship management. Evaluate their experience with confidential deal processes, stakeholder communication, and integration with M&A-specific tools. Look for vendors who can demonstrate M&A-specific use cases, provide references from similar-sized M&A teams, and offer customization capabilities without requiring extensive technical resources. The vendor should understand that M&A teams need immediate productivity, not lengthy implementation projects that distract from active deals.

4. Obtenir une démonstration

Test CRM platforms with real M&A scenarios to assess their practical effectiveness for your team's specific workflows. During trials, focus on how quickly your team can set up deal tracking, import existing contacts, and begin managing active transactions. Pay particular attention to user experience, since M&A professionals need intuitive tools that enhance rather than complicate their daily workflows. folk CRM offers a comprehensive demo that demonstrates M&A-specific features in action. Schedule your demo here to see how folk can transform your M&A operations.

3 conseils pour mettre en place un CRM

1. Importez vos données dans votre nouveau CRM

Seamlessly transition your existing M&A contacts, deal information, and stakeholder relationships to your new CRM system. Start by exporting your current data as CSV files from existing systems—you can export from HubSpot following these instructions, or from Pipedrive using these guidelines. This ensures all your critical M&A relationships, transaction history, and deal progress transfer smoothly to your new platform, maintaining continuity in your active deals and preserving valuable stakeholder information.

2. Créez votre premier pipeline

Design your M&A pipeline with stages that reflect the complexity of mergers and acquisitions processes. Establish stages like "Target Identification," "Initial Contact," "Management Meeting," "Preliminary Due Diligence," "LOI Submission," "Detailed Due Diligence," "Final Negotiations," and "Transaction Closing." This specialized pipeline helps your team track each deal's progress systematically and ensures critical M&A milestones and deliverables aren't overlooked during complex transactions.

3. Intégrez votre équipe

Ensure rapid adoption across your M&A team by providing focused training on how the new CRM enhances their specific M&A workflows. Conduct hands-on sessions showing how to track acquisition targets, manage investor communications, and coordinate due diligence processes within the CRM. Emphasize how the system improves their daily efficiency in managing relationships, tracking deal progress, and coordinating with colleagues, encouraging consistent usage that maximizes collaboration and deal management effectiveness.

Conclusion

Selecting the best CRM for mergers and acquisitions is crucial for M&A teams of 20-50 people seeking to streamline complex deal processes, enhance stakeholder relationships, and maximize transaction success. After evaluating platforms like folk, HubSpot, Salesforce, Pipedrive, and Zoho, folk CRM emerges as the clear leader for mid-sized M&A teams. folk delivers the perfect balance of sophisticated M&A functionality, intuitive design, and cost-effective pricing at $20-$60 per user monthly. Unlike enterprise solutions that require extensive setup and technical resources, or basic platforms that lack M&A-specific capabilities, folk provides immediate productivity with features designed specifically for deal management, stakeholder tracking, and confidential communications. HubSpot and Salesforce offer powerful capabilities but at enterprise pricing levels and complexity that overwhelm mid-sized teams, while Pipedrive and Zoho lack the sophisticated features essential for complex M&A transactions. For M&A teams ready to transform their deal management and relationship tracking, try folk CRM for free here and experience how the right CRM can accelerate your transaction success.

👉🏼 Try folk now to automate contact enrichment and confidential outreach for faster M&A closes

Besoin d'un coup de main ? Utilisez notre outil gratuit pour trouver le CRM qui vous convient le mieux.

FAQ

What is the best CRM for mergers and acquisitions?

For 20–50 person M&A teams, folk leads with customizable pipelines, executive enrichment, email sequences, and 6,000+ integrations at $20–$60/user/month. Salesforce/HubSpot are powerful but pricier; Pipedrive/Zoho are simpler with fewer M&A features.

Do M&A teams need a CRM?

Yes. A CRM centralizes deal data, standardizes stages, automates follow‑ups, and improves stakeholder visibility, reducing missed deadlines and speeding due diligence, negotiations, and close.

How much does a CRM cost for a 20–50 user M&A team?

Expect $20–$60/user/month for folk; $24–$129 Pipedrive; $20–$50 Zoho; $25–$500 Salesforce; $15–$1,500 HubSpot. Annual costs for 50 users range from ~$24k to $300k+. Include setup, add‑ons, and integration fees.

How to choose a CRM for M&A teams?

Prioritize customizable pipelines, executive contact enrichment, secure email sequences, LinkedIn and DocuSign/VDR integrations, M&A analytics, and fast onboarding. Run a trial with live deals and confirm pricing scales for 20–50 users.

Découvrez l'

CRM folk Comme l'assistant commercial que votre équipe n'a jamais eu